July 31, 2014 | Conformance basics

Knowing the ins and outs of conformances can make a huge difference on the job.

Read More »

Knowing the ins and outs of conformances can make a huge difference on the job.

Read More » Wage investigations by the U.S. Department of Labor are increasing, and that’s good news for contractors who play by the rules.

Wage investigations by the U.S. Department of Labor are increasing, and that’s good news for contractors who play by the rules.

However, the Department of Labor alone can’t keep watch on every project based on the sheer magnitude of work taking place. For example, in 2016, the U.S. federal government spent $289.6 billion on construction contracts via 543,627 transactions, according to USASpending.gov.

The DOL works diligently to ensure wage laws are followed, but initiatives such as Spotlighting Cheating Contractors are essential to identifying potential wage violations.

The graphs showcase the federal statistics on Davis Bacon wage investigations provided by Tim Helm, Chief of the U.S. Department of Labor, Wage and Hour Division, Division of Enforcement Policy and Procedures, Branch of Government Contracts Enforcement.

The data was provided during a special enforcement update held April 23, 2013, in Washington, D.C.

Davis Bacon Act (DBA) wage determinations do not contain every craft and wage rate needed for all DBA work performed on every contract. When this occurs, DBA provisions contain a procedure for the purpose of establishing a DBA-enforceable wage and benefit rate for the missing job classification. The procedure involves obtaining a conformance.

What is a conformance and why one may be necessary?

A conformance is the addition of a classification of trade and the corresponding wage rate (hourly rate and fringe benefits) not listed on a DBA wage determination that is incorporated into a DBA-covered contract. When a necessary trade is not listed in the incorporated wage determination, it is necessary for a contractor to apply for a conformance with the U.S. Department of Labor (DOL). The conformance process has the limited purpose of establishing a new classification when it is necessary to do so because the work needed to perform the contract is NOT performed by an existing classification.

Conformances are not appropriate when the work of the proposed classification is already performed by a classification set forth on the wage determination.

Who initiates the conformance process?

Generally, the contractor performing the covered work initiates the request by preparing an SF-1444, Request for Authorization of Additional Classification and Rate, after the award of the general contract and at the time of employment of the unlisted trade. The contractor submits the SF-1444 to the contracting agency who then submits it to the DOL for review and approval or denial.

Your support is critical to helping the Spotlighting Cheating Contractors initiative restore fairness in government bidding. Only with your participation can we instill fear in non-compliant contractors and ensure heightened compliance on prevailing wage projects.

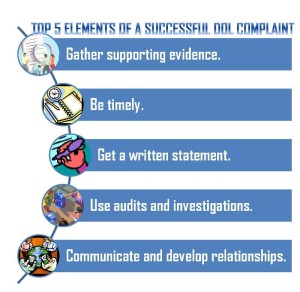

To help you with the U. S. Department of Labor complaint process, we’re sharing five tips aimed at making it more successful:

To help you with the U. S. Department of Labor complaint process, we’re sharing five tips aimed at making it more successful:

Labor Management Compliance Council, through years of regulatory compliance work, compiled the top five hurdles in investigating potential prevailing wage violations. They are:

Accessing Gatekeeper: It’s not always clear which government agency administers the project and is responsible for maintaining contract documents and certified payroll information. Yet, this is the first step to submitting a FOIA or State Public Records Request.

Slow Process: Depending upon the government agency, the production of documents can take several weeks to several months. A delay in the production of documents can have devastating effects.

Information Withheld: The most critical information – such as wage rate, wages paid and fringe benefits – is often withheld by the government agency on the grounds that it’s protected because it invades personal privacy or reveals business trade secrets. This information is necessary to build sufficient evidence in a complaint.

Bureaucratic Red Tape: The administrative review and appeal process is bureaucratic as it relates to federal and state public records processes, which can be very difficult to navigate.

Complaint Roadblocks: The delay associated in receiving pertinent information substantially impacts the ability to file prevailing wage or public works complaints. Generally, the U.S. Department of Labor does not accept prevailing wage complaints after a project is finished. And the California Division of Labor Standards Enforcement is legally required to complete its investigation and assess all fines and penalties within 180 days of the formal completion of a project. Not obtaining the necessary documents in a timely manner may lead to losing any rights for filing a prevailing wage complaint.

Labor Management Compliance Council has been successful overcoming these obstacles. We’ve done it by cultivating relationships with Freedom of Information Act (FOIA) and public records officers and understanding how to work with the agencies involved.

At the beginning of the compliance monitoring process, and as soon as practicable, LMCC alerts the contracting agency to let the key contact person know who we are and how we will be submitting FOIA or public records requests for pertinent information related to the project at issue.

Once LMCC receives requested documents, they are reviewed to determine if all pertinent data and reports have been delivered. If any part of those records are missing or heavily redacted, LMCC contacts the contracting agency. LMCC also involves its legal team to assess administrative options.

Labor Management Compliance Council started back in 2015. Although we have people in our office that have a combined knowledge of Compliance for well over 35 years. We want to educate contractors as well as sub-contractors on how important it is to abide by the laws, pertaining to Public Works Labor Laws and Regulations.